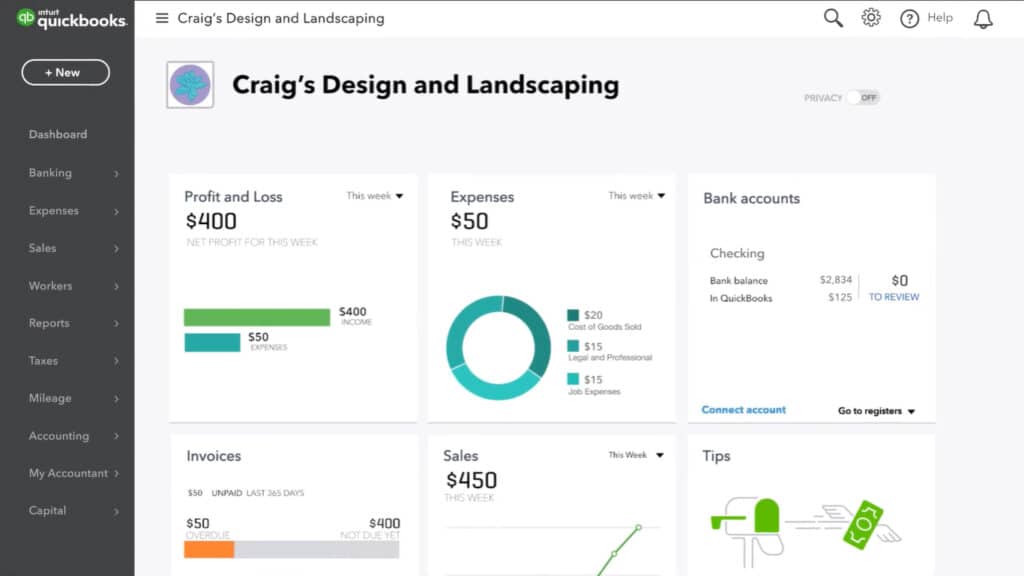

Connecting the credit card details and bank account details can reduce the data entry time. Additionally, it increases the security of the company files. Using QuickBooks increases the number of transactions in your account. As you result, you will have to categorize the expenses. You can learn how to categorize expenses in QuickBooks after going through the entire article.

You can manage or categorize them by categorizing the construction materials, recording the construction expenses, entering the construction costs, and choosing the construction account. Choose the Batch Action and follow the prompts if you want to categorize many transactions simultaneously.

This article will get detailed instructions on categorizing expenses in QuickBooks, creating custom categories, and the type of expenses in a firm. If you are looking for the best way to manage your business expenses, follow the steps mentioned in this article.

What Are The QuickBooks Expenses?

Whenever you pay for any service or goods, it is considered an expense in QuickBooks. You can edit, delete, and record expenses in QuickBooks Online and Desktop accounting software. It helps you record the profit and loss. Categorize the transactions to record them in your account. QuickBooks can manage the following types of Expenses:

- Travel Expenses.

- Advertising Expenses.

- Office Supplies Expenses.

- Specialists ServicesExpenses.

- Workplace Accessories Expenses.

Things To Consider Before Categorizing Expenses

Using the QuickBooks tool lets you decrease the chances of mistakes. Additionally, it makes your accounting more secure. You need to consider these points:

- Split the expenses.

- Match the transaction details.

- Run the bank reconciliation report.

- Ensure that the reconciliation is accurate.

- Matching and Adding are both different processes.

Create Custom Expense Categories

You can create a custom expense category to manage your expenses. You must follow the steps mentioned below:

- Firstly, click the Accounting tab.

- Choose the Chart of Accounts tab from the dashboard.

- After that, click on the New option and click Other Expenses.

- Navigate to the Date tab and fill out the expense date.

- Then, fill out additional information to continue further.

- Finally, close the Expenses window and save the changes.

How To Categorize Expenses In QuickBooks?

Go through the instructions mentioned below to learn how to categorize expenses in QuickBooks:

- Firstly, go to the Vendor Center and click the Vendors option.

- Tap on the drop-down icon and select the New Vendor tab.

- Then, click on the Vendor Name field.

- Select the Currency tab and tap the Currency option.

- After that, type the required details and save the transaction.

- Go to the Category section and tap Category to proceed.

- Finally, save the changes to categorize expenses in QuickBooks.

Read More:- How To Record A Refund From A Vendor In QuickBooks Online 2022?

Remove Expenses From The Budget

You can remove the expenses from the budget list. Here are the steps to remove them:

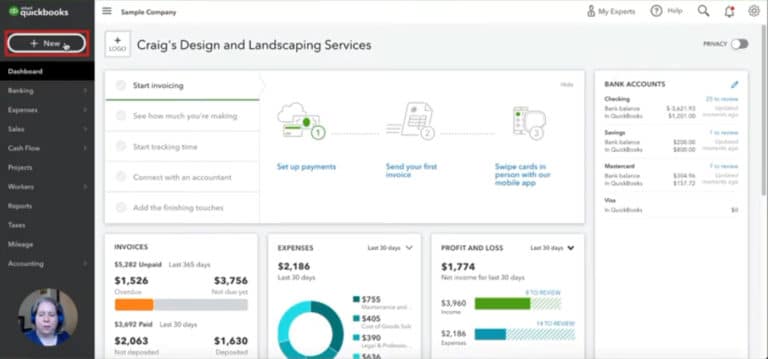

- Firstly, click the New option from the left panel and tap Expenses.

- Go to the Action window and tap the View or Edit tab.

- Then, choose Delete to continue further in the process.

- Tap Yes to confirm your actions.

- After that, delete the Expenses from the window.

- Finally, update your Budget details and save the changes.

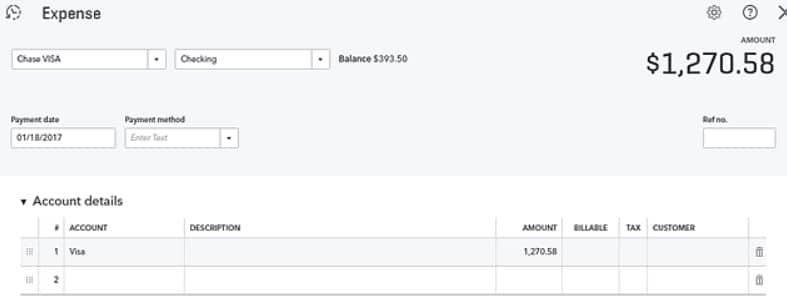

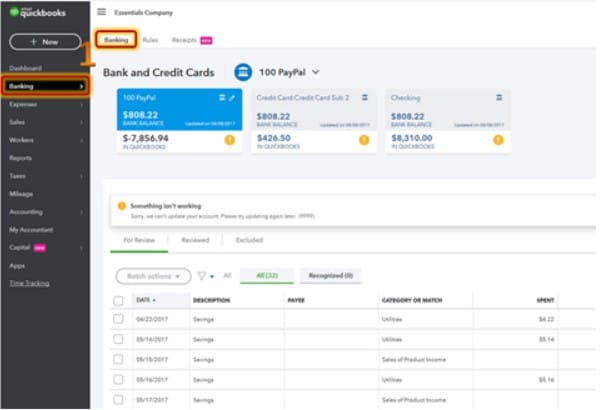

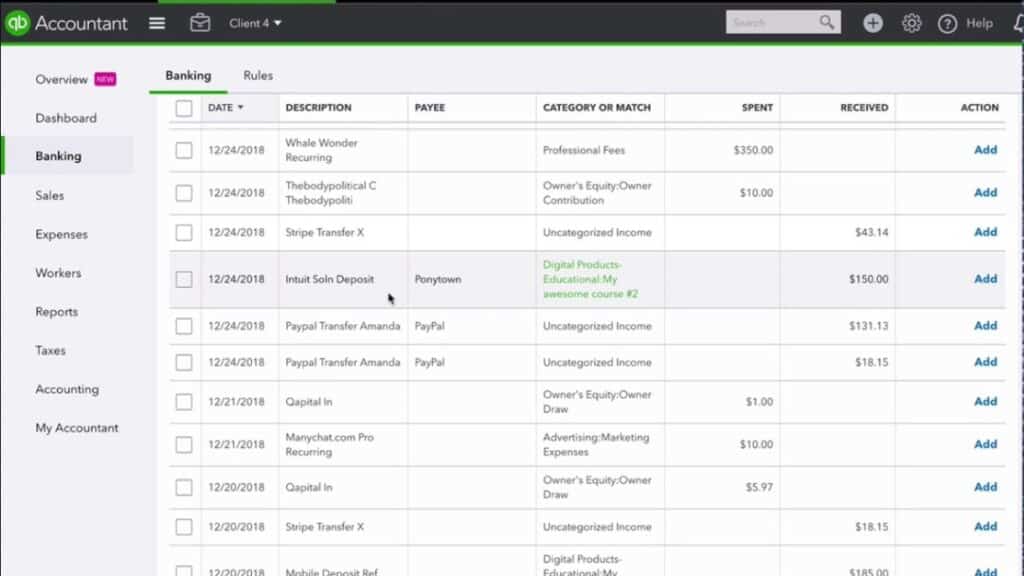

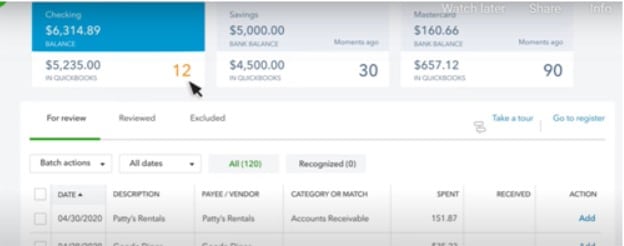

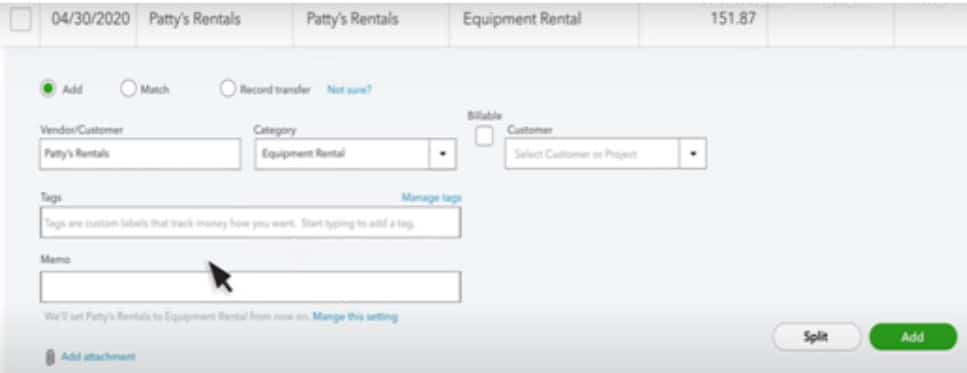

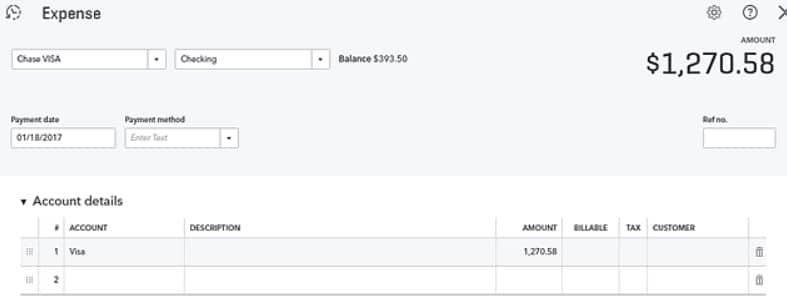

Categorizing the Bank And Credit Card Expenses

The process is similar for Credit Card and Bank accounts. Here are the steps to categorizing credit card and bank expenses:

- First of all, launch the QuickBooks software.

- Click the Banking tab from the top Menu bar.

- Then, select Banking to proceed further in the process.

- Select your Bank Account from the window.

- After that, go to the Review tab to continue.

- Tap the expense from the list to make changes.

- Then, fill out the required details and tap Add.

- Finally, confirm your actions and finalize the process.

Different Types Of Expenses You Can Categorize

Here are the steps to categorize different types of expenses:

Categorize Construction Expenses

Go through the steps mentioned below to learn how to categorize expenses in QuickBooks:

- Firstly, tap the New tab from the top left panel.

- Select the Products & Services option.

- Then, tap More and click Manage Categories from the drop-down menu.

- Click New to create a new category for construction expenses.

- After that, you can choose any old category next to the construction materials.

- Go to the Chart of Accounts tab and click Account.

- Then, tap New and click Continue to record transactions.

- Locate the Category column and select your category.

- Finally, tap Save to categorize expenses in QuickBooks.

Categorize Website Expenses

Website expenses may be considered as your business expenses. You can create a custom category for the expense. Follow these instructions to learn how to categorize expenses in QuickBooks:

- First of all, select the Expenses tab under the New window.

- Choose Business Expenses to proceed further.

- After that, click on the Other Common Business Expenses tab.

- Tap Start or Update to continue.

- Then, locate and tap the Website Expenses from the category column.

- You can create a subcategory for the expense.

- Finally, tap Save to categorize website expenses in QuickBooks.

Categorize Office Cleaning Expenses

Office cleaning expenses come under the specialist’s services. You can add the category in your transactions to categorize these expenses. Follow the instructions mentioned below to learn how to categorize expenses in QuickBooks:

- First of all, tap + icon from the Dashboard menu.

- Choose the Expenses option from the drop-down menu.

- After that, open the transaction list and select your Transaction.

- Locate and click the Category column.

- Then, choose the custom category or create a new one.

- Click Apply to save the category in the transaction.

- After that, choose the Batch Action option to add the category for more transactions at once.

- Finally, save the changes to finalize the process.

Categorize Business Expenses

Firstly, you need to create a Business category in the Category column. After that, follow the steps mentioned below to categorize expenses in QuickBooks accounting software:

- Firstly, select the New option or tap + icon from the top navigation bar.

- Choose the Expenses option and select your Vendor.

- After that, choose the payment account and transaction.

- Go to the Category column and choose a Business category.

- Then, follow the on-screen prompts and enter the required information.

- Finally, save the Expenses and categorize expenses in QuickBooks.

Final Words

The rules feature lets you categorize the latest transactions. Read the above article to learn how to categorize expenses in QuickBooks Desktop and Online. The article also includes steps to Categorize Website Expenses, Construction Expenses, Office Cleaning Expenses, and Business Expenses in QuickBooks.

If you are unable to categorize these expenses, then call us for proper assistance. MWJ Consultancy offers proper assistance to resolve Quicken, TurboCASH, Sage, TurboTax, and Xero queries and issues. We have a team of experts that are experienced and certified. We are always happy to help you.

Frequently Asked Questions

Firstly, you need to create a category or subcategory for the transactions. After that, you can select the transactions under the expenses tab. Click here for the step-by-step process.

Here is how you can learn how to categorize expenses in QuickBooks:

- Firstly, create the category or subcategory.

- After that, categorize the construction materials.

- Then, enter your expenses, cost, and other details.

- Finally, choose the account and categorize expenses.

You can categorize office cleaning expenses similar to other expenses. Create an office cleaning category or subcategory. Follow the same method to add a category to a transaction. Choose Bulk Action to select more transactions.

Here are the steps to learn how to categorize expenses in QuickBooks:

- Click the New tab in the top navigation bar.

- Tap Expenses and choose the transaction.

- Select the Category tab and choose Business Expenses.

Select Save to categorize business expenses in QuickBooks.